The Southern Santa Barbara real estate market closed out October 2025 with a significant burst of activity, defying cooler national trends and reinforcing its status as a resilient, high-demand coastal enclave.

Our analysis of the latest statistics reveals a complex, two-speed market: a surge in monthly transactions driven by shifting mortgage rates, coupled with robust, long-term price appreciation across the board year-to-date.

Here is your full market breakdown for Southern Santa Barbara County through October 2025.

October’s Snapshot:

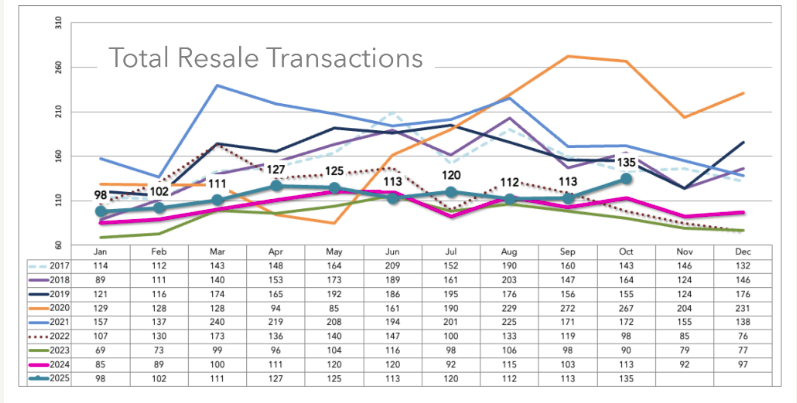

October was marked by a substantial jump in closed transactions, suggesting a late-fall surge in buyer confidence, likely fueled by the decline in mortgage rates seen throughout the month.

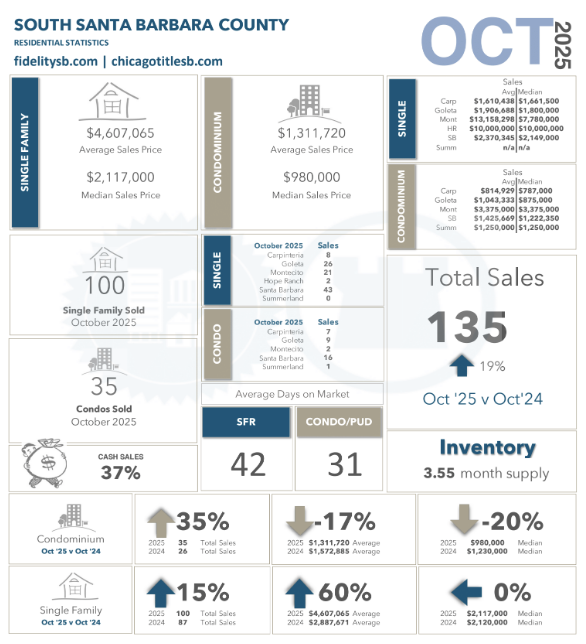

| Metric | Oct 2025 | Change from Oct 2024 | Commentary |

| Total Residential Sales | 135 | +19% | A strong increase in closed volume, reflecting renewed buyer enthusiasm. |

| Single Family Sales | 100 | +15% | Robust activity for standalone homes. |

| Condominium Sales | 35 | +35% | The highest percentage gain indicates improved affordability in the condo sector. |

| Median Sales Price (SFR) | $2,117,000 | Stable (0%) | The middle price point held firm, suggesting stability after previous growth. |

| Average Sales Price (SFR) | $4,607,065 | +60% | Skewed heavily by multiple high-end luxury sales, reflecting the strength of the top-tier market. |

| Cash Sales | 37% | N/A | Cash buyers remain highly active, ensuring speed and certainty for sellers. |

Export to Sheets

The Luxury Factor: The dramatic 60% year-over-year increase in the Single Family Average Sales Price (hitting over $4.6 million) is a clear indicator of sustained momentum in the high-end sector, which remains a key driver of overall market value in Southern Santa Barbara.

Affordability & Speed: The Condominium segment saw a 35% increase in sales volume, with both the average and median prices declining, which points to a healthy turnover of inventory in the sub-$1.2 million range. This indicates that as national mortgage rates dropped into the low 6% range, buyers moved swiftly to capitalize on entry and mid-level opportunities.

The market remains fast, with only a 3.55-month supply of inventory. Single-Family Homes sold in an average of 42 days, while Condos were even quicker, moving in just 31 days.

Year-to-Date (YTD) Performance: Price Appreciation Holds Strong

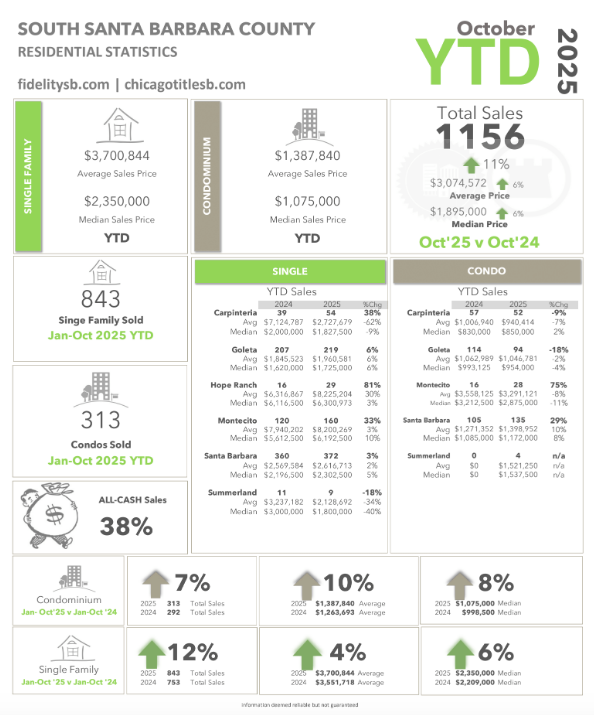

While October was strong, the Year-to-Date data (YTD October 2025) provides a broader, more conservative view of the market’s underlying health.

Despite a slight cooling in overall transaction volume, price appreciation remains substantial.

| Metric | YTD Oct 2025 | Change from YTD Oct 2024 |

| Total Sales Volume | 1,156 units | -11% |

| Overall Median Price | $1,895,000 | +6% |

| Overall Average Price | $3,074,572 | +6% |

| SFR Median Price | $2,350,000 | +6% |

| Condo Median Price | $1,075,000 | +8% |

Export to Sheets

Key Takeaways from YTD Data:

- Price Growth is Consistent: The consistent 6% YTD growth in both Average and Median Prices (overall market) shows that while fewer homes may be selling (a result of limited inventory and higher rates earlier in the year), the value of Southern Santa Barbara real estate continues to climb.

- Condos Lead Price Gains: Condominiums and PUDs, often the most accessible option for buyers, saw the strongest YTD median price increase at +8%.

- Cash is King: A remarkable 38% of all YTD transactions were all-cash sales, highlighting the depth of wealth in the market and insulating a significant portion of local activity from mortgage rate fluctuations.

Regional Context and What It Means for You

The local market is operating successfully against a mixed national backdrop.

- Mortgage Rate Relief: The average 30-year fixed mortgage rate dropped to a year-low of approximately 6.19% in late October, down from highs above 7% earlier in 2025. This improvement in borrowing power has encouraged fence-sitting buyers to re-enter the market, directly contributing to the October surge in sales volume.

- National Cooling vs. Local Demand: While national reports indicate slower activity and listing price declines in the Western region, Santa Barbara remains an outlier. The South Coast’s desirability, limited buildable land, and strong luxury component continue to exert massive upward pressure on prices. The local inventory challenge (3.55 months) is far tighter than the national average, making the market consistently competitive.

Final Outlook

The Southern Santa Barbara real estate market remains fundamentally strong, characterized by low inventory and unwavering high demand.

The October surge in sales volume suggests buyers are adjusting to the “new normal” of interest rates and seizing opportunities as they arise, particularly in the entry-level condo market. For sellers, strategic pricing and a well-presented property continue to yield quick sales and strong final values, especially as YTD prices continue to appreciate across all segments.

Are you ready to make a move? Whether you are navigating the competitive single-family home sector or looking to capitalize on the renewed activity in the condo market, now is the time to connect with a local real estate professional who understands these unique, high-value trends.

MARKET TRENDS