South Santa Barbara County Real Estate: 2025’s Market Mood Swings

As Q3 wraps and September’s stats roll in, South Santa Barbara County’s residential market tells a tale of recalibration. After years of pandemic-fueled frenzy, 2025 is shaping up as the year the market caught its breath—albeit with a few raised eyebrows and some price tags still flexing their luxury muscles.

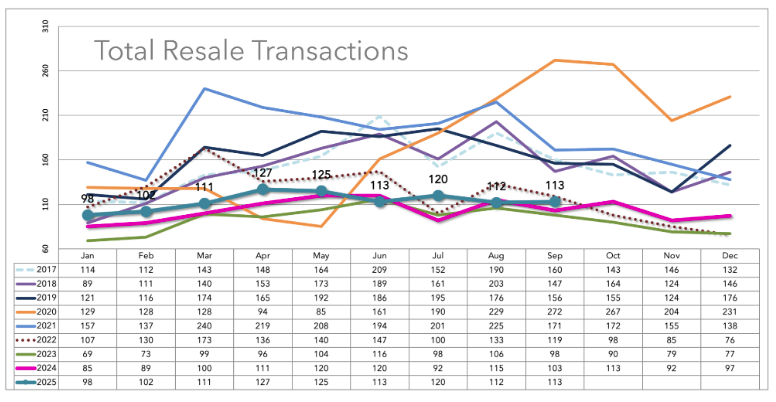

Single-Family Homes: High Prices, Slower Pace

- Average Sales Price (Sept): $3.19M (↓ 4% YoY)

- Median Sales Price (Sept): $2.35M (↓ 11% YoY)

- Days on Market: 50 (↓ 11%)

- Cash Sales: 37%

- Sales Volume: 65 homes sold (↓ 4%)

Despite a dip in pricing, the single-family segment remains a high-stakes game. Montecito and Hope Ranch continue to anchor the top end, with average prices north of $6M and $7M, respectively. But even these enclaves saw double-digit declines in sales volume, suggesting buyers are more selective—or simply waiting for the next wave.

Condominiums: Holding Steady, Quietly Climbing

- Average Sales Price (Sept): $1.66M (↑ 6% YoY)

- Median Sales Price (Sept): $1.18M (↑ 4% YoY)

- Days on Market: 32 (↓ 14%)

- Cash Sales: 21%

- Sales Volume: 48 condos sold (↓ 17%)

Condos are the quiet achievers of 2025. While sales volume dipped, pricing held firm and even ticked upward. Montecito condos saw a jaw-dropping 66% increase in average price year-to-date, while Santa Barbara’s condo market posted a healthy 6% gain. Inventory remains tight, and buyers are moving quickly when the right unit hits.

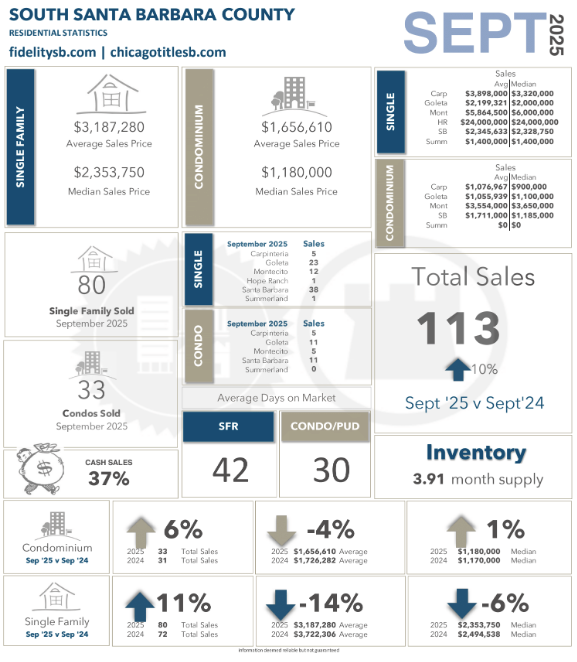

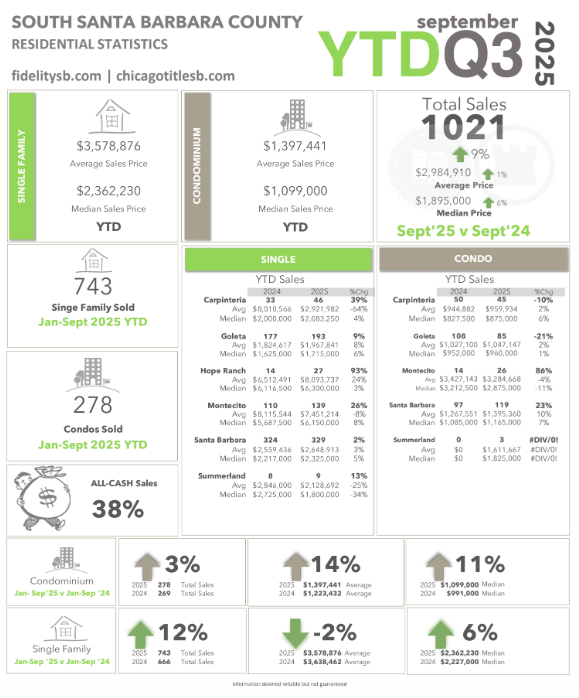

Year-to-Date Snapshot (Jan–Sept 2025)

- Single-Family Homes Sold: 743 (↓ 9%)

- Condos Sold: 278 (↓ 11%)

- Total Sales: 1,021 (↓ 9%)

- Inventory: 3.91 months of supply

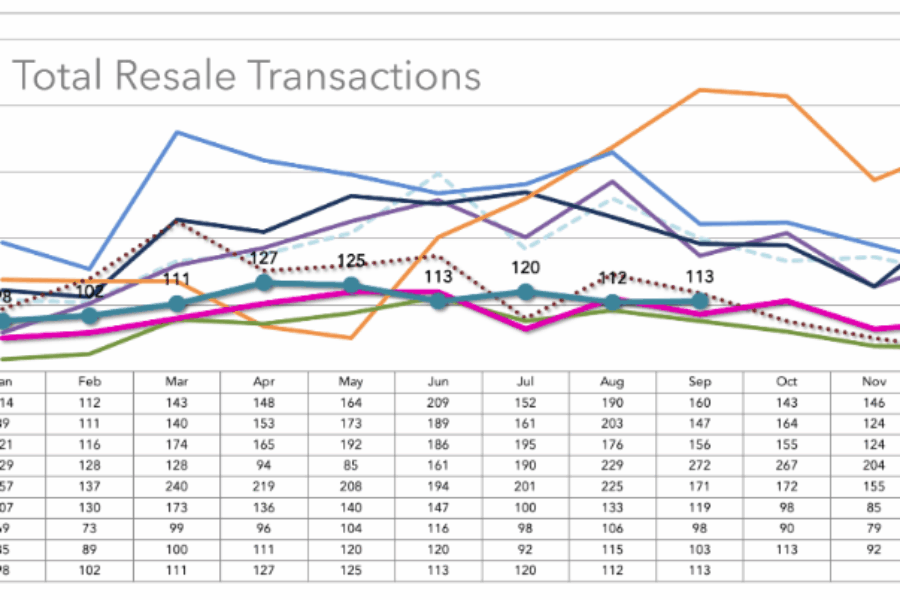

The year-over-year slowdown is real—but it’s not a crash. It’s a normalization. Compared to the hyperactive years of 2020–2021, 2025’s transaction volume is subdued. Monthly resale activity has hovered at 95 units since January, a stark contrast to the 200+ deals per month seen during peak pandemic years.

Sales by Price Range: The Tale of Two Markets

- $3M–$5M: 19 single-family homes sold

- $5M+: Another 19 single-family homes sold

- $1M–$1.5M: Most active condo range (17 units)

Luxury is still moving—but it’s concentrated. The mid-range ($1.5M–$3M) saw modest activity, while entry-level inventory remains scarce. Only two condos sold under $500K, and zero single-family homes did. Affordability? Still a unicorn.

What It All Means

2025 is a year of recalibration. Prices are softening in some sectors, but not collapsing. Inventory is lean, and buyers are discerning. Sellers are adjusting expectations, especially in the high-end market. And while the volume is down, the quality of transactions—cash-heavy, quick-moving, and price-conscious—is telling.

Santa Barbara’s market isn’t cooling off—it’s refining. The frenzy is gone, but the fundamentals remain strong. If you’re buying, patience and precision are key. If you’re selling, pricing strategy matters more than ever.

There’s an old real estate adage: The last homes to go up in value are condominiums, and the first to come down are condominiums…This adage holds water—and 2025’s data from South Santa Barbara County backs it up. Condos often trail single-family homes in both booms and busts, acting as a bellwether for broader market sentiment.

Here’s why the saying rings true, and how it’s playing out locally:

The Logic Behind the Adage

- Condos are typically entry-level or investor-friendly, so they attract buyers who are more price-sensitive and reactive to interest rate shifts.

- In a rising market, single-family homes surge first, driven by lifestyle upgrades, scarcity, and emotional buying. Condos follow once affordability becomes a barrier.

- In a cooling market, condos are the first to feel the chill—buyers pull back, investors hesitate, and inventory builds faster.

2025: A Case Study in Santa Barbara

- Condo sales dropped 17% year-over-year in September, while single-family home sales only dipped 4%.

- Days on market for condos fell to 32, suggesting that well-priced units still move—but fewer are trading hands.

- Average condo prices rose 6%, but this may reflect a shift in what’s selling (e.g., high-end Montecito units) rather than broad appreciation.

- Single-family homes saw price declines—down 4% on average and 11% median—but held stronger in volume and cash buyer activity.

So while condos are showing resilience in pricing, they’re clearly leading the retreat in transaction volume. That’s textbook behavior for a market in transition.

What It Means for Buyers and Sellers

- Buyers: If you’re condo-hunting, you may find more negotiating room and less competition. But don’t expect a fire sale—inventory is still tight.

- Sellers: Pricing strategy is critical. The days of bidding wars are behind us (for now), and buyers are scrutinizing every HOA fee and square foot.

Final Take

Condos are the canary in the coal mine. When they slow down, it’s often a signal that the broader market is shifting. In 2025, they’re not crashing—but they are blinking yellow. If you’re watching the horizon, keep your eyes on the condo data. It’s often the first to whisper what’s coming next.