- The average rate on the popular 30-year fixed mortgage hit 3.70% on Friday, the lowest since November 2016, according to Mortgage News Daily. That rate will likely dip even lower Monday, as bond yields continue to fall.

- The drop last week meant that 8.2 million 30-year mortgage holders could likely qualify for a refinance and save at least 0.75% off of their current interest rate by doing so, according to a new tally by Black Knight, a mortgage software and analytics company.

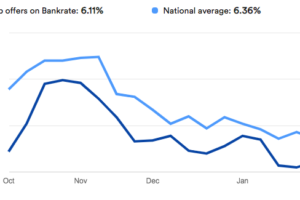

- While rates are now incredibly favorable for both refinance and home purchases, consumers still need to shop around for the best rate, and a full one-third of them are not, according to a new survey from Fannie Mae.

About Mark Danforth Lomas

This author hasn't written their bio yet.

Mark Danforth Lomas has contributed 621 entries to our website, so far.View entries by Mark Danforth Lomas

You also might be interested in

Afternoon Contrast at Butterfly by local artist Chris Potter This[...]

Don't wait! Mortgage Rates remain high and it is unlikely rates will drop this year. Real Estate experts are urging home buyers not to wait as home prices are expected to rise. It’s a challenging market for buyers and Fannie Mae is predicting an increase in home prices through 2025. Don’t wait Rising costs aren’t the only obstacle for buyers as low inventory is also impacting the market’s dynamics. If Baby Boomers ever decide to move/downsize some experts believe that will put 9 million homes on the market over the next 10 years. Wait and see? Don't wait. Click Read More below for mortgage rate update and videos.

Mortgage rates drop to historic lows! Below 3%!

Contact Us

About Us

Analyze Your Investment

iAnalyzeREI: Real Estate Investment Analysis

Santa Barbara Links

- City of Santa Barbara

- County of Santa Barbara

- Culture Santa Barbara

- Debris Flow Maps

- FEMA MAP

- Montecito Journal

- Noozehawk

- Pearl Chase Society

- Ready Santa Barbara

- Santa Barbara Magazine

- Santa Barbara Realtors

- Santa Barbara Zoo

- Santa Barbara's "Lotusland"

- Santa Barbara's Hiking Trails

- Santa Barbara's News Press

- SB EdHat Local News

- SB Farmers Markets

- SB Independent Newspaper

- SB Museum of Natural History

- SB Public Libraries

- SB Senior Care Guide

- SB's KEYT Television

- Senior Care Resources

- Senior Guide to Medicare Benefits

- Siteline Santa Barbara

- The Mojo aka The Montecito Journal

- The Montecito Association

- Unity Shoppe

Categories

Archives

This website is not the official website of Sun Coast Real Estate. Sun Coast Real Estate does not make any representation or warranty regarding any information, including without limitation its accuracy or completeness, contained on this website. Real Agents affiliated with Sun Coast Real Estate are independent contractors and not employees.

3112 State Street, Santa Barbara, California 93105

Mark Lomas BRE 00898298

Kirsten Wolfe BRE 01309570