As we move into the final stretch of the year, the Southern Santa Barbara real estate market is showing a remarkable blend of seasonal cooling and underlying structural strength. While the “holiday hum” usually quiets the market, the 2025 data tells a story of stability, precision pricing, and a luxury sector that continues to defy broader economic gravity.

1. The November Snapshot: Resilience in the Numbers

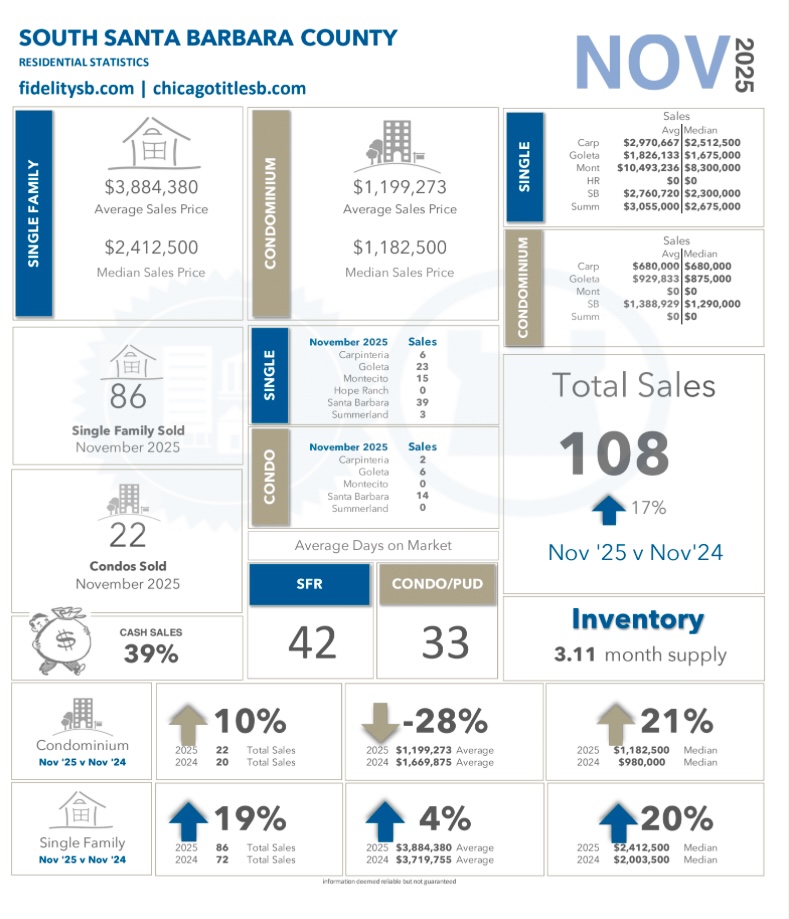

Looking at our November data, the South Coast remains a high-demand environment.

- Closed Sales: Total transactions are up approximately 17% compared to November of last year. This suggests that despite being a “seasonal” month, buyers are staying active later into the year than usual.

- Days on Market: We are seeing a “tale of two markets.” Well-priced, move-in-ready homes are entering escrow in under 30 days, while properties with “aspirational” pricing are lingering closer to 50–60 days.

- Inventory: We currently sit at roughly 3.1 months of inventory. While this is an increase from the ultra-tight levels of 2024, it remains firmly in “Seller’s Market” territory.

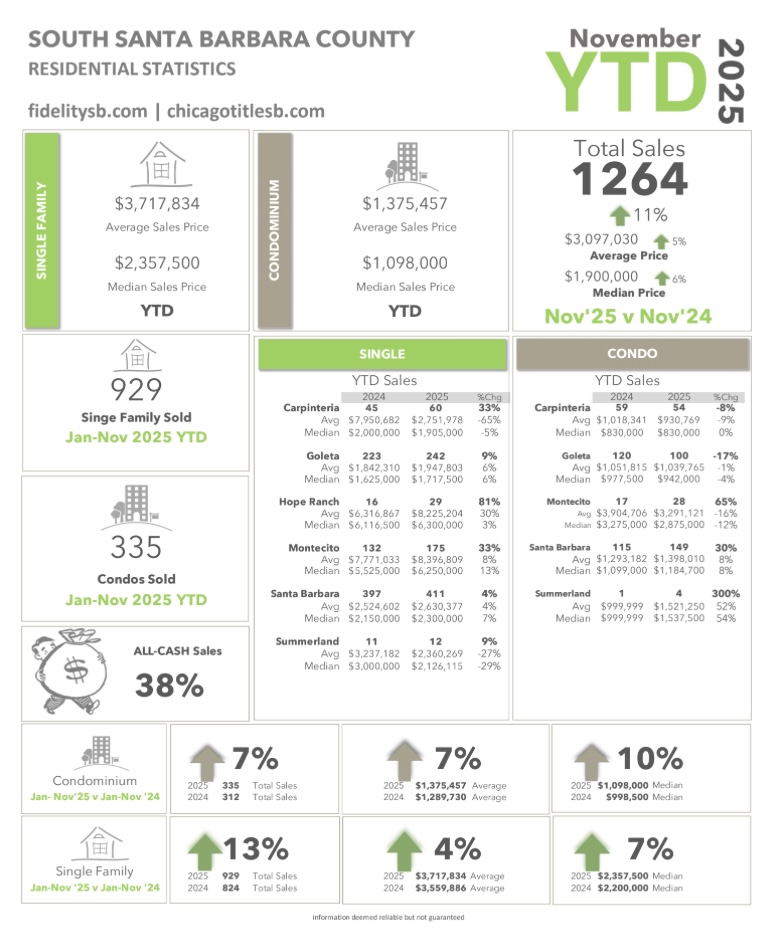

2. Year-to-Date (YTD): A Year of Recovery

Our Year-to-Date chart highlights a significant recovery in sales volume.

- Volume & Appreciation: Total sales volume has reached over $3.2 billion, a nearly 19% increase over 2024.

- Median Price Growth: The YTD median price for single-family homes is holding strong at $2.37 million (+7.7% YOY).

- Condo Stability: The condo segment remains the “anchor” for entry-level buyers, with a YTD median price of $1.05 million.

3. Key Market Trends to Watch

The Market Trends graphic reveals the nuances of our local micro-markets:

- The “Montecito Momentum”: The luxury tier ($5M+) is surging, heavily influenced by global wealth and the “AI-equity” boost. Montecito saw median prices jump significantly this fall, with multiple sales exceeding the $20M mark.

- The Cash Factor: Roughly 39% of all November transactions were all-cash. This high liquidity helps insulate the South Coast from minor fluctuations in mortgage rates.

- Pricing Precision: The market is rewarding sellers who price accurately from day one. Properties priced within 5% of market value are seeing multiple offers, whereas overpricing leads to an eventual sale price ~10% lower than the original ask.

What This Means for You

For Sellers: Inventory is slowly creeping up, meaning you have more competition than you did six months ago. However, the lack of “turn-key” inventory means that if your home is polished and priced correctly, you still hold the cards.

For Buyers: The slight rise in inventory and stabilizing interest rates (hovering in the low 6s) offer more “breathing room” to negotiate. Winter can be a strategic time to find motivated sellers before the spring rush begins.

Pro Tip: Keep an eye on the “South Coast Inventory” trend. As we approach 2026, the gap between “Active Listings” and “Sold” is a key indicator of where prices will head next.

Leave a Reply

Your email is safe with us.