What That Means For Santa Barbara

Federal Reserve Chair Jerome Powell’s recent speech at Jackson Hole sent ripples through financial markets—and a few hopeful waves toward the California coast. With Powell signaling that “the shifting balance of risks may warrant adjusting our policy stance,” economists are now betting on a potential interest rate cut at the Fed’s September meeting.

But what does that mean for Santa Barbara’s real estate scene, where ocean views meet sticker shock?

A Market in Transition

Santa Barbara’s housing market has been riding a curious wave. Inventory is growing, homes are sitting longer, and price cuts—some as steep as $500,000—are popping up across listings. While some agents still call it a seller’s market, others see a more neutral playing field emerging.

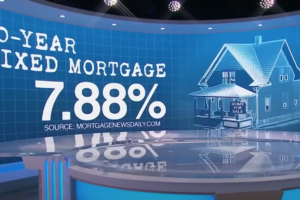

Lower interest rates could be the tide change buyers have been waiting for. Mortgage rates, which hovered above 7% earlier this year, are now dipping toward 6.2%, with some experts predicting a slide into the 5% range. That’s enough to lure sidelined buyers back into the game, especially for homes under $2 million.

Local Voices, Real Impact

Guy Rivera, a Santa Barbara-based mortgage banker, says he’s already fielding more calls since Powell’s speech. “It’s going to affect [mortgage rates], but not now. It’s going to affect it in the future weeks from now,” he told KEYT News.

Realtor Dan Johnson adds, “We’ve got inventory building and interest rates dropping. Buyer opportunities are developing, and sellers need to get realistic on pricing.” In other words, the dance between buyers and sellers might finally find a new rhythm.

What to Watch

- Inventory vs. Demand: More homes on the market could mean better deals—but only if buyers feel confident.

- Election Wildcard: With November looming, political uncertainty could shake up both rates and buyer sentiment.

- Luxury Segment: Ultra-high-end homes are still commanding attention, but broader affordability may hinge on rate cuts.